Taking a loan to buy a home is an important financial choice. A slight difference in interest rate makes a lot of difference, so one should compare banks before deciding to buy a home loan.

‘Business Standard’ has compiled a list of the home loan rates offered by various financial institutions.

Public sector banks

Union Bank of India is offering interest rates in the range of 8.35 per cent to 10.90 per cent.

Bank of Baroda from 8.4 per cent to 10.90 per cent.

Punjab National Bank from 8.4 per cent to 10.25 per cent.

Bank of India from 8.4 per cent to 10.85 per cent.

Central Bank of India is offering interest rates in the range of 8.45 per cent to 9.80 per cent.

Here is a list of home loans offered by public sector banks:

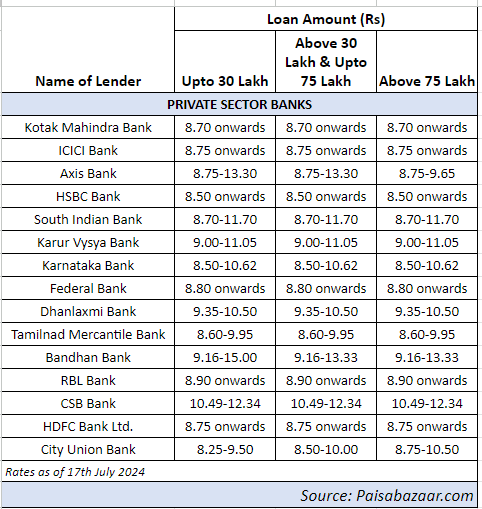

Karnataka Bank’s interest rate is in the range of 8.50 per cent to 10.62 per cent.

HSBC Bank is offering an interest rate of 8.50 per cent onwards.

Kotak Mahindra Bank is offering an interest rate of 8.70 per cent onwards.

South Indian Bank is offering interest rates in the range of 8.70 per cent to 11.70 per cent.

ICICI Bank is offering an interest rate of 8.75 per cent onwards.

Here is a list of home loans offered by private sector banks:

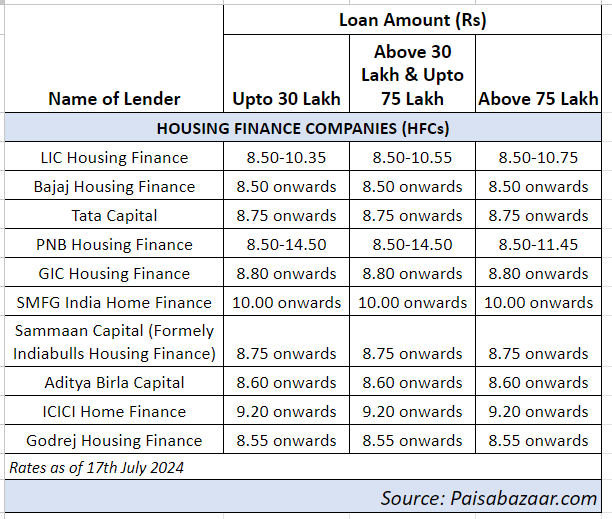

Housing finance companies

LIC Housing Finance’s rate is in the range of 8.50 per cent to 10.75 per cent.

Bajaj Housing Finance is offering an interest rate of 8.50 per cent onwards.

Godrej Housing Finance is offering interest rate of 8.55 per cent onwards.

Aditya Birla Capital is offering an interest rate of 8.60 per cent onwards.

Tata Capital is offering an interest rate of 8.75 per cent onwards.

PNB Housing Finance is offering interest rates in the range of 8.50 per cent to 14.50 per cent.

Sammaan Capital (formerly Indiabulls Housing Finance) is offering interest rate of 8.75 per cent onwards.

Here is a list of home loans offered by housing finance companies:

First Published: Jul 18 2024 | 1:44 PM IST